Table of Contents

Table of Contents

If you strip away tools, dashboards, and automation, ecommerce is built on one simple behavior: people compare options before making a choice. Product data makes that comparison possible. Titles, prices, images, ratings, stock updates, and delivery timelines influence what users click, trust, and ultimately purchase.

In any online shopping flow, product details silently shape every decision. When someone compares two phones or checks a price difference between retailers, ecommerce product data is doing the heavy lifting. Modern buying behavior depends on consistently accurate information pulled together from multiple sources and displayed in seconds.

For businesses, this data isn’t just helpful; it is fundamental. Pricing teams track competitor activity before major sale periods. Marketplace teams rely on clean product attributes so filters, search, and recommendations function correctly. Brand managers review how their products appear across different retailers and whether any details have drifted from the correct version. Without reliable data, decision-making becomes uncertain, and opportunities are harder to spot.

This is where product data scraping becomes essential. No team has the bandwidth to manually check dozens of product pages daily. Scaling to hundreds or thousands is nearly impossible without errors. Automated scraping fills that gap by collecting structured data consistently, allowing teams to monitor catalogues, compare the market, evaluate competitors, and respond quickly to changes.

What Is Product Data Scraping?

Product data scraping refers to the automated collection of product information from publicly accessible web pages. Instead of visiting each page manually and copying details, automated scripts or scraping tools extract data at scale, structure it, and deliver it in a usable format such as spreadsheets, dashboards, or API responses.

A typical setup collects information like:

- product names

- pricing and discounts

- ratings and reviews

- stock availability

- images or image URLs

- product attributes

- seller information

Tools simply read what is publicly displayed in the browser, similar to how a user sees it. There is no hidden access, and no private information is retrieved; only the same product details are visible to any customer.

The difference is scale and consistency. A human might review a few pages per hour. A scraper can collect hundreds within minutes and repeat the process on a schedule.

When businesses need reliable visibility for price monitoring, catalogue health checks, or competitive analysis, automated collection becomes significantly more efficient than manual review.

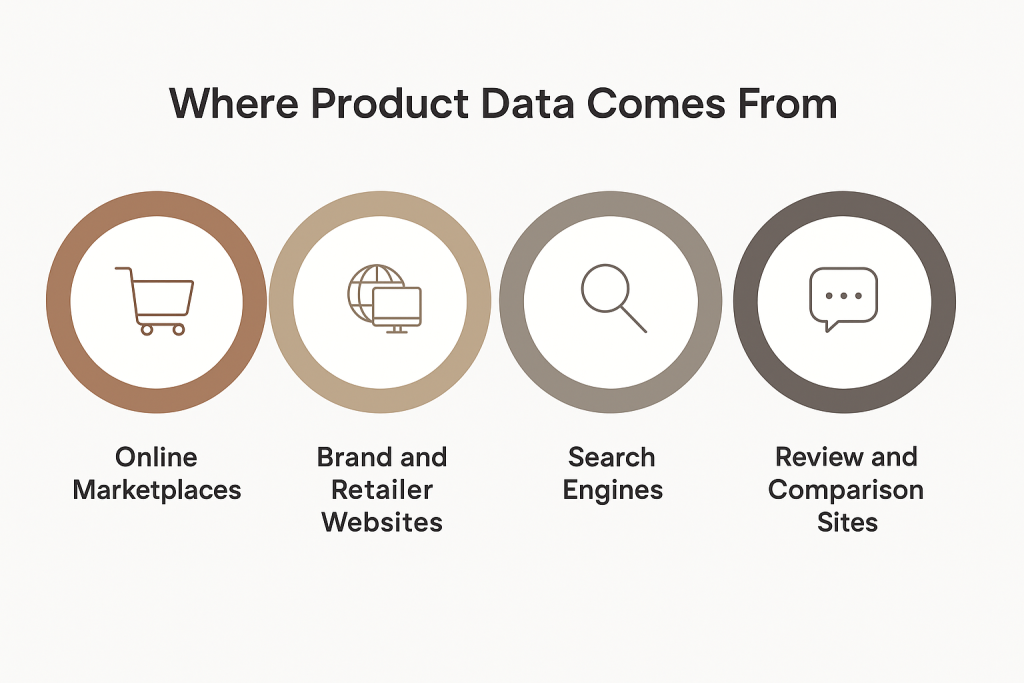

Where Product Data Comes From

Most of the product information used in ecommerce workflows is already public. The challenge isn’t access but volume. Here are the primary sources used across industries:

1. Online Marketplaces

Marketplaces like Amazon, Flipkart, Walmart, and similar platforms hold some of the most active and frequently updated product listings. These pages regularly include:

- titles and descriptions

- prices and promotional discounts

- ratings and review volumes

- seller names

- shipping information

Teams monitor these listings to track pricing changes, new competitors, and presentation differences. Marketplaces often change faster than brand sites, making them crucial for trend visibility.

2. Brand and Retailer Websites

These sites typically provide the most accurate product information. Brands control this content, so specifications, images, sizing charts, and descriptions are updated directly. Many organizations treat these pages as their internal “source of truth.”

Scraping these sites helps teams identify mismatches between official product information and what appears on third-party marketplaces.

3. Search Engines

Search engines aggregate data from multiple retailers and surface high-visibility product snippets. This helps teams understand:

- Which products dominate search visibility

- pricing ranges in competitive categories

- Which product features appear most often in highlights

SEO teams often rely on these insights to determine content gaps and positioning opportunities.

4. Review & Comparison Portals

These platforms provide additional context through curated lists, ranking systems, expert commentary, and user feedback. While not always complete, they help businesses understand how customers perceive products beyond basic listings.

What Data Teams Usually Collect

Product data scraping isn’t about collecting anything unusual; it’s about converting what is already visible on product pages into structured information that can be analyzed and compared.

Core fields often include:

- Title – how the product is positioned

- Price – including discounts or promotional offers

- Currency – necessary for global comparisons

- Product URL – for reference

- Images – or their URLs

- Ratings & Reviews – indicators of social proof

- Stock Status – availability signals

- Brand or Seller Name – source of the listing

Depending on the product category, additional attributes matter.

For example:

Fashion: size, color, material, fit notes

Electronics: storage, RAM, model, release year

Home & furniture: dimensions, material, assembly details

Beauty: ingredients, shade, usage notes

Most teams begin with 8–12 fields that influence buying behavior. Starting with a clear attribute list makes scraping operations cleaner and ensures that all stakeholders receive consistent data.

Why Brands Invest in Product Data Scraping

As product catalogues expand, the volume of information that requires monitoring increases accordingly. Pricing changes, new sellers, updated variants, and shifting marketplace standards all influence how products appear online. Manual checks simply cannot keep pace. Brands rely on structured product data scraping because it offers consistent, verifiable insights that support real business decisions.

1. Pricing Intelligence

Pricing teams operate in categories where even small shifts can affect conversions. With scraping, they get a steady feed of reliable information such as:

- updated prices and temporary discounts

- bundle changes or new promotional structures

- competitor price adjustments before major sale periods

- New sellers are entering with aggressive pricing

Having this information in near-real time helps teams respond with precision rather than reacting after the market has already shifted. In categories like electronics, beauty, and home appliances, this accuracy directly affects revenue planning.

2. Trend and Demand Insights

When data is collected consistently, it reveals patterns that don’t show up during occasional manual checks. Brands can see:

- Which variants sell out the fastest

- How often do specific features or colours go out of stock

- Whether a product’s visibility changes across marketplaces

- seasonality patterns that repeat year over year

These insights help category managers adjust inventory planning, production priorities, and listing strategies. They reduce guesswork and help teams react before stock issues impact sales.

3. Competitor Tracking

Competitor monitoring becomes significantly more effective when it’s backed by structured product data. Scraping provides visibility into:

- new model launches or refreshed product lines

- improved images or enhanced listing quality

- stronger titles or spec variations designed to convert better

- price shifts that signal competitive positioning

Because this information is collected consistently, brands can track how competitors evolve rather than relying on one-off checks. This forms a more stable foundation for strategic decisions.

4. Catalogue Accuracy and Brand Consistency

In many categories, a single product appears on multiple marketplaces and retailer sites. Over time, these listings can drift, images get replaced, specifications become outdated, or descriptions lose detail. Brands often discover issues such as:

- incorrect or missing attributes

- old product images being reused

- mismatched technical specifications

- inconsistencies in titles or sizing information

Automated data scraping helps teams detect these issues early. With a reliable view of how products appear across platforms, they can request corrections, maintain brand consistency, and prevent misinformation from affecting customer decisions.

Common Misconceptions About Product Data Scraping

Misconception 1: Scraping is illegal.

This belief arises in almost every conversation with beginners. In most cases, teams collect publicly visible product information – titles, prices, ratings, images, the same details a shopper sees. The legal considerations typically concern how the data is collected and whether the process adheres to local guidelines.

To stay safe, established brands often review their approach with compliance teams instead of avoiding the entire practice.

- Public product details are not private data

- Legality depends on the method and use

- Companies handle it through responsible processes

Misconception 2: Only developers can do this.

Scraping used to be purely technical. That’s no longer the case. Many teams now use no-code dashboards or API tools that simplify the process into clean exports. They just select the fields they want and receive structured data without writing scripts.

- Non-technical users can operate scraping tools

- APIs and dashboards hide complexity

- Technical teams step in only for advanced setups

Misconception 3: It runs automatically forever.

Scraping is automated, but not magical. Websites update layouts, add new variants, or change how product details are displayed. A stable setup handles most of this, but occasional adjustments keep data accurate.

- Automation works, but not without oversight

- Layout changes can affect data flow

- Regular checks maintain reliability

Misconception 4: Scraping replaces strategy.

It doesn’t. Scraping replaces manual checking, not judgment. Teams still need to analyze pricing trends, check competitor actions, and make decisions that require context and experience.

- Scraping is support, not strategy

- Human insight guides decisions

- Data is only as useful as the team interpreting it

How Teams Use Scraping Without Writing Code

Most companies now rely on tools that hide the technical layer. Users simply define:

- which sites to monitor

- which product fields to collect

- How often is data refreshed

The tool handles extraction, formatting, and delivery.

Teams typically consume the output through:

- dashboards showing price trends, stock levels, or new listings

- CSV/Excel exports for pricing, merchandising, and category teams

- internal APIs feeding product data into BI tools or internal dashboards

The workflow looks like this:

- Business users define what they need

- Tools or services extract the data

- Different teams use the structured output for analysis and daily decisions

This makes scraping accessible for organizations of any size without requiring deep technical involvement.

Conclusion

Product data scraping isn’t complicated once you understand what it delivers. It simply collects the same details shoppers rely on, titles, prices, images, ratings, and stock updates but does it at a scale teams can actually use. When this information is structured and refreshed consistently, brands get a clearer view of how their products appear, how competitors move, and where the market is shifting.

Teams across pricing, merchandising, and operations use scraped data to make decisions based on evidence instead of assumptions. It helps them catch price changes early, keep catalogs accurate, and spot trends that usually go unnoticed during manual checks. The value doesn’t come from automation alone; it comes from giving experts better visibility so their decisions carry more weight.

If you’re starting, focus on the product details that influence your work the most. Identify the fields that matter: pricing, availability, key attributes and imagine how much easier your role becomes when those details update automatically every day. That single step will guide you toward the scraping setup that actually supports your goals.